For many Filipino families, the struggle with utang feels never-ending. Credit card bills piling up, personal loans from banks, a neighbor’s “5-6” balance, or even appliance installment plans that seemed manageable at first – all of these can quietly snowball into stress. After the pandemic, when job losses and reduced income pushed countless Pinoys to borrow , it became even harder to break free.

- 📝 Step 1 – Assess and List All Debts

- 💡 Step 2 – Create (or Adjust) Your Budget to Find Extra Money

- ⚖️ Step 3 – Choose a Debt Payoff Strategy (Snowball vs. Avalanche)

- 🤝 Step 4 – Negotiate with Creditors

- 🔄 Step 5 – Consolidate or Refinance (If Possible)

- 💪 Step 6 – Find Extra Income (“Side Hustle to Pay Hustle”)

- 🎯 Step 7 – Pay Consistently and Celebrate Milestones

- ❓ FAQs About Getting Out of Debt in the Philippines

- 🚀 From Utang Stress to Financial Freedom

But here’s the good news: no matter how heavy your financial load feels, you can get out of debt. The first step is confronting it head-on instead of hiding it out of shame. In our culture, maraming nahihiya to admit their debts, but avoiding the problem only makes it worse. By facing the numbers and creating a plan, you take back control – and every peso you pay is a step closer to freedom.

This guide is your Pinoy-friendly playbook to becoming debt-free. From making your “utang map” to budgeting wisely, negotiating with creditors, and even finding extra income, we’ll walk through the practical steps that many Filipino families have used to finally breathe easier. Kaya mo ‘to – with discipline and family teamwork, financial freedom is within reach.

| Step | What to Do | Why It Matters |

|---|---|---|

| 1. Assess and List All Debts | Write down all utang with balance, interest, and due dates (your “utang map”). | Facing the numbers gives clarity and control. |

| 2. Create or Adjust Your Budget | Track income/expenses, cut back on non-essentials, free up cash. | Every peso saved can go to debt payments. |

| 3. Choose a Payoff Strategy | Pick Snowball (smallest debts first) or Avalanche (highest interest first). | Having a clear plan keeps you motivated and efficient. |

| 4. Negotiate with Creditors | Call banks, talk to family lenders, ask for amnesty or new terms. | Creditors prefer repayment plans over defaults. |

| 5. Consolidate or Refinance | Combine debts into a lower-interest loan (SSS, Pag-IBIG, personal loan). | Saves thousands in interest; simplifies payments. |

| 6. Find Extra Income | Take on side hustles (online selling, freelance, delivery, food biz). | Extra cash accelerates debt payoff significantly. |

| 7. Pay Consistently & Celebrate Wins | Automate payments, avoid new debt, celebrate small milestones. | Consistency builds momentum until you’re debt-free. |

📝 Step 1 – Assess and List All Debts

The very first step to get out of debt is simple but often the hardest: face the numbers. Many Pinoys avoid checking their balances dahil nakakahiya or nakakatakot makita ang total. But here’s the truth – not knowing makes the problem worse. Once you see the full picture, you’ll feel more empowered to take action.

Think of it as creating your own “utang map.” This means writing down:

- Who you owe (creditor) – e.g., BDO credit card, SSS loan, tita, kapitbahay.

- How much is left (remaining balance).

- Interest rate – so you know which ones cost you the most.

- Due dates – to avoid missed payments and penalties.

Here’s a simple format you can copy into a notebook, Excel sheet, or even a piece of bond paper:

| Creditor / Utangan | Balance (₱) | Interest Rate | Due Date |

|---|---|---|---|

| BDO Credit Card | ₱25,000 | 3%/month | Every 15th |

| SSS Salary Loan | ₱18,000 | 10%/year | Every 30th |

| Neighbor (5-6) | ₱5,000 | 20%/month | Daily |

| Appliance Installment (TV) | ₱12,000 | 0% (promo) | Every 5th |

When you see it written out, two things happen:

- Clarity – You’ll know exactly what you’re dealing with (no more guessing).

- Priority – You’ll start spotting which debts are urgent (e.g., high-interest credit card or 5-6 loans).

👉 Pro tip: Use color coding. Mark the highest interest debts in red, medium in yellow, and lowest in green. This quick visual cue will help when you decide on your payoff strategy later.

Remember: don’t be afraid of the numbers. Facing them is the bravest move you can make – and it’s the first real step toward financial freedom.

💡 Step 2 – Create (or Adjust) Your Budget to Find Extra Money

Once you’ve listed all your debts, the next move to get out of debt is to find the money to pay them. And that starts with a solid budget.

Many Filipinos live sweldo to sweldo – what comes in goes out right away. That’s why setting up (or adjusting) a monthly budget is crucial. The goal is to spot where your money is going, then reallocate some of it toward debt payments.

✍️ How to Build Your Budget

- List all income – Your salary, sideline, or any regular cash inflows.

- List all expenses – From rent, groceries, utilities, transportation, down to small things like GCash load or daily kape sa karinderya.

- Find cutbacks – Look for areas where you can trim down.

Here are some realistic ways Pinoys can free up cash:

- Bring baon to work instead of eating out (saves ₱100/day = ₱2,000/month).

- Downgrade or cut cable/streaming subscriptions.

- Save on kuryente: unplug appliances, use electric fan instead of aircon when possible.

- Limit food delivery and dine-ins – mas tipid kung magluto sa bahay.

👨👩👧 Family Involvement

Debt payoff is easier when the whole household understands the mission. Explain to kids in simple terms: “Tipid-tipid muna tayo so we can pay our utang and have a better future.” Small sacrifices now mean big wins later.

📊 Sample Budget Reallocation

Here’s a sample monthly breakdown to show how small adjustments can free up cash:

| Category | Before (₱) | After (₱) | Savings for Debt (₱) |

|---|---|---|---|

| Eating Out / Delivery | 4,000 | 2,000 | 2,000 |

| Cable & Streaming | 1,500 | 800 | 700 |

| Electricity | 4,000 | 3,500 | 500 |

| Shopping / Non-essentials | 3,000 | 2,000 | 1,000 |

| Total Extra for Debt | 4,200 |

That ₱4,200 saved each month can go directly toward paying down a credit card balance or clearing a small loan. Over a year, that’s ₱50,400 – malaking tulong sa pagbayad ng utang.

👉 Remember: your budget isn’t about depriving yourself forever. It’s about temporary sacrifices so you can finally breathe debt-free in the future.

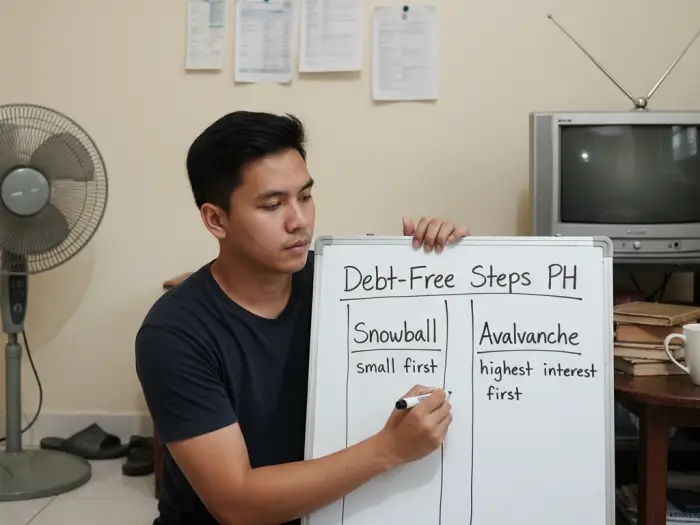

⚖️ Step 3 – Choose a Debt Payoff Strategy (Snowball vs. Avalanche)

Now that you know your debts and have adjusted your budget, it’s time to decide how you’ll attack your utang. The two most effective methods are the Debt Snowball and the Debt Avalanche.

Both strategies work – the key is to pick the one that best fits your personality and situation.

❄️ Snowball Method – For Quick Wins

- Focus on paying the smallest debt first, while making minimum payments on the rest.

- Once one debt is cleared, you “roll” that payment into the next smallest debt.

- Pinoys often like this because ang sarap ng feeling when you tick off one utang quickly – it gives momentum and boosts morale.

🔥 Avalanche Method – For Maximum Savings

- Focus on paying the highest interest debt first (usually credit cards or 5-6 loans).

- You still pay minimum on others, but extra money goes to the costly debt.

- This saves you the most money in the long run because high-interest loans eat up your cash.

📊 Example Comparison

Let’s say you have:

- Credit Card: ₱25,000 at 3%/month (36% per year)

- 5-6 Loan: ₱5,000 at 20%/month

- SSS Loan: ₱18,000 at 10%/year

| Method | What You Pay First | Why It Works | Best For |

|---|---|---|---|

| Snowball | 5-6 Loan (₱5k) → then SSS → then Credit Card | Clears small debts fast, boosts morale | People who need motivation and small wins |

| Avalanche | Credit Card (₱25k at 36%) → then 5-6 → then SSS | Saves the most on interest, faster overall | People disciplined enough to wait for the “big win” |

👉 Some Pinoys even combine the two: clear one or two small debts quickly (Snowball for motivation), then switch to Avalanche for bigger, high-interest balances.

The important thing is not which method you choose – it’s that you stick to a plan. Consistency is what will finally crush your debts.

🤝 Step 4 – Negotiate with Creditors

Here’s a secret most Filipinos don’t realize: you can actually talk to your creditors. Many assume na once you can’t pay, tapos na – but in reality, most lenders prefer adjustment over total default. Whether it’s a bank, a pawnshop, or even a kapitbahay, showing good faith and proposing a plan can make a big difference.

🏦 Credit Card Companies & Banks

- Amnesty or Restructuring Programs – Banks sometimes let you convert overdue balances into a fixed-term loan with much lower interest (or even zero interest for a set period). Example: a ₱50,000 unpaid balance can be restructured into a 24-month plan with manageable monthly dues.

- Request Lower Interest / Waived Fees – Politely ask if late fees or finance charges can be waived, lalo na if you’ve been a loyal customer before falling behind.

- Tip: Call the bank’s collections department, be honest about hardship, and show willingness to pay. The worst they can say is “no,” but often they’ll offer options.

👨👩👧 Personal Loans or Utang from Family/Friends

- Be Transparent: Tell them exactly how much you can commit (e.g., “Tita, I can pay you ₱1,000 every 15th and 30th”).

- Put It in Writing: Even a simple text or note avoids misunderstandings.

- Show Consistency: Keep your promise, kahit maliit lang – trust is everything in family loans.

💸 Informal Lenders (5-6 / Loan Sharks)

- Safety First: If you’re dealing with 5-6, avoid confrontations. If you can’t keep up, try negotiating smaller, regular payments instead of disappearing.

- Community Mediation: Barangay officials can sometimes mediate if payments become too stressful or unsafe.

- Reality Check: If interest is abusive, prioritize wiping out these debts ASAP with snowball/avalanche methods or consolidation (see Step 5).

🔒 Pawnshops & Collateral Loans

- Extensions: If you have jewelry, gadgets, or even land titles in pawn, ask for an extension or partial payment to prevent losing them.

- Negotiate for Roll-Over: Many pawnshops allow you to just pay the interest due to extend the loan period.

👉 Golden Rule: Always approach your creditors before you default, not after. A person who shows willingness and a plan is more likely to get flexible terms.

🔄 Step 5 – Consolidate or Refinance (If Possible)

If you’re juggling multiple high-interest debts, one smart way to get out of debt is consolidation. This means combining several expensive loans into just one, ideally with a lower interest rate.

For Filipinos, this could mean:

- Taking a salary loan from SSS, GSIS, or Pag-IBIG (usually around 10% per year).

- Applying for a personal loan with a lower interest rate compared to credit cards.

- Using a collateral loan (like pawning jewelry or securing a loan with your car/land title) – but only if you’re confident you won’t default, dahil may risk of losing the asset.

📊 Example: Why Consolidation Can Save You Big

Imagine you’re paying these debts:

- Credit Card: ₱25,000 at 3% per month (36% per year)

- 5-6 Loan: ₱5,000 at 20% per month (crazy expensive!)

- SSS Salary Loan option: 10% per year

If you borrow ₱30,000 from SSS to pay off both the credit card and the 5-6 loan, look at the difference:

| Loan Type | Balance (₱) | Interest Rate | Annual Interest (₱) |

|---|---|---|---|

| Credit Card | 25,000 | 36% | 9,000 |

| 5-6 Loan | 5,000 | 240% | 12,000 |

| Total (Before) | 30,000 | Mixed | 21,000 |

| Consolidated SSS Loan | 30,000 | 10% | 3,000 |

👉 By consolidating, you save ₱18,000 a year in interest alone. That’s money that can now go straight to principal repayment instead of just feeding lenders.

⚠️ A Word of Caution

Consolidation is powerful, but only if you stay disciplined. If you pay off your credit cards with a loan but then start swiping again, you’ll dig yourself into an even deeper hole. That’s why many financial coaches advise cutting or freezing your credit card once you’ve consolidated.

Think of it as a reset button: it gives you a chance to breathe, but you need to change habits to stay debt-free.

💪 Step 6 – Find Extra Income (“Side Hustle to Pay Hustle”)

Budgeting and consolidation can only go so far. To truly get out of debt faster, sometimes the best move is to increase your income. Every extra peso you earn and funnel into your utang shortens the time you’re stuck paying interest.

🔎 Where to Look for Extra Income

- Declutter & Sell: Old gadgets, clothes, or baby items can be sold online (Shopee, Carousell, FB Marketplace).

- Part-Time Gigs: Freelance work (graphic design, tutoring, virtual assistant jobs) or weekend hustles like food stalls or selling kakanin.

- Ride-Hailing / Deliveries: Grab, Angkas, or Lalamove – many Pinoys earn a few thousand monthly on flexible schedules.

- Home-Based Side Businesses: Baking, laundry service, or online reselling.

- Family Contribution: Teenagers can do tutoring or summer jobs, spouses can start a micro-business (like crafts or online selling).

📊 Sample Pinoy Side Hustles & Potential Income

| Side Hustle | Effort/Time | Extra Monthly Income (₱) |

|---|---|---|

| Sell unused items online | 2–3 weekends | 3,000–8,000 (one-time bursts) |

| Weekend food sales (kakanin, bbq) | Fri–Sun nights | 5,000–10,000 |

| Freelance VA / Tutor | 10–15 hrs/week | 8,000–15,000 |

| Grab/Lalamove driver | 2–3 nights/week | 6,000–12,000 |

| Online reselling (clothes, gadgets) | Flexible | 4,000–10,000 |

👉 Even ₱3,000 extra per month, if consistently applied to debt, means ₱36,000 a year. That’s enough to clear a small loan or cut years off a big one.

👨👩👧 Family as a Team

Remember, this is temporary. Once debts are gone, you can scale back the hustles and enjoy more free time. Involve your family so everyone feels part of the solution – from kids cutting down on expenses to spouses running a small home-based gig.

Treat every peso from side hustles as “debt-only money.” Don’t mix it with daily gastos. The more disciplined you are, the sooner you’ll taste freedom.

🎯 Step 7 – Pay Consistently and Celebrate Milestones

By now, you have your utang map, a budget, a payoff strategy, maybe even a consolidation loan and some extra income. The last big ingredient to finally get out of debt? Consistency.

🔄 Automate Your Payments

- Treat debt repayment like a non-negotiable bill. On payday, set aside money immediately – before you’re tempted to spend it.

- Use online banking or auto-deduct features to transfer payments straight to creditors. Less temptation = more progress.

🏆 Celebrate Small Wins

Paying off debt can take months or even years. That’s why you need small celebrations to stay motivated.

- Cleared your first loan? Treat the family to a pizza night.

- Finished paying off a credit card? Go for a simple day at the park or a home-cooked feast.

- The key is to reward yourself without going back into debt.

🚫 Avoid New Debt

This part is crucial. Don’t undo your progress by swiping a card or taking new loans. Here are some practical ways:

- Hide or cut up your credit cards. Some Pinoys even leave theirs with a trusted sibling or spouse.

- Stick to cash or debit only.

- For emergencies, borrow from family with no interest only if absolutely necessary – and treat it as part of your repayment plan.

📞 What If You Already Defaulted?

If a debt has gone to collections (like a credit card turned over to a third-party agency):

- Know your rights: They cannot harass or threaten you with jail – utang is not a criminal case in the Philippines.

- Negotiate a settlement: Banks sometimes accept 30–50% lump sum payments for old debts.

- Get it in writing: Always request an official clearance letter once settled.

💰 Build a Small Emergency Fund (Alongside Debt Payments)

It might sound strange, but saving a little while paying debt can prevent relapses. Even setting aside ₱200–₱500 per payday builds a cushion for emergencies like medicine or small car repairs. That way, you won’t need to borrow again.

👉 Once your debts are cleared, scale that fund to cover 3–6 months of expenses. This is your shield against falling back into the utang cycle.

❓ FAQs About Getting Out of Debt in the Philippines

1. Should I pay off my loans or save/invest first?

For high-interest debts like credit cards or 5-6, always pay those off first – no investment can beat the 36% interest you’re paying. Once the bad debts are cleared, you can start saving and investing aggressively.

2. Is it okay to have some “good debt”?

Yes. Housing loans or small business loans can be considered good debt if they help build long-term assets. But consumer debt (shopping, gadgets, unnecessary credit card use) should be avoided.

3. What if my spouse or family keeps adding debt?

The whole household needs to be on board. Sit down and talk openly about how debt affects everyone, and agree on rules (like cutting up credit cards). Treat it as a family mission, not finger-pointing.

4. Can I really negotiate with banks to lower my payments?

Yes, banks often allow restructuring or amnesty programs if you show willingness to pay. Call them before defaulting, and always ask about converting overdue balances to a term loan.

5. What’s the difference between debt snowball and avalanche?

Snowball targets the smallest debts first for quick wins. Avalanche targets the highest-interest debts first to save more money overall. Both work – choose what keeps you motivated.

6. Should I get a consolidation loan even if it means new debt?

If the new loan has a much lower interest rate, it can save you thousands yearly. Just make sure you don’t run up your old credit cards again, or you’ll double your problem.

7. How do I deal with collectors calling me non-stop?

Stay calm and know your rights – harassment and threats are illegal. Ask about settlement options, and request all agreements in writing before paying.

8. Is life without utang really possible in the Philippines?

Yes! Many Filipinos live within their means and save up before buying big items. It takes discipline and a mindset shift, but financial freedom is very achievable.

9. Can I still save while paying debt?

Yes, set aside a small emergency fund (even ₱200–₱500 per payday) while focusing on debt. This prevents you from borrowing again when small emergencies happen.

10. How do I stay motivated if paying off debt takes years?

Break the journey into milestones. Celebrate small wins with your family – simple joys like a pizza night or outing – to keep the momentum alive.

🚀 From Utang Stress to Financial Freedom

Getting out of debt isn’t just about numbers – it’s about regaining peace of mind. Every peso you pay, every small sacrifice you make, brings your family closer to freedom. Think of it like climbing a mountain: mabigat sa umpisa, pero the higher you go, the lighter you’ll feel.

Many Filipinos have done it – from sari-sari store owners who slowly paid off microloans, to OFWs who cleared credit cards and built savings instead. The common thread? Discipline, teamwork, and a clear plan.

So don’t lose hope. Whether you’re battling credit card bills, 5-6, or multiple loans, remember that financial freedom is possible. One day, you’ll look back at your “utang map” and smile knowing those balances are all zero.

Kaya ninyo ‘to. With every step, you’re not just paying debt – you’re building a stronger, debt-free future for your family.