In the Philippines, one emergency can shake a family’s entire budget — a hospital bill, a lost job, a child who suddenly needs school payments, or even a typhoon that wipes out everything. And when those moments hit, many Filipinos look for help but don’t always know where to start or which government program applies to their situation.

- 🌿 DSWD Assistance Programs (AICS, Medical, Funeral, Education)

- 🌿 PhilHealth Benefits and Medical Coverage for Filipinos

- 🌿 PCSO Medical Assistance Program (Guarantee Letters, Hospital Support)

- 🌿 Pag-IBIG Benefits and Assistance Programs (Housing, Calamity, MP2 Savings)

- 🌿 SSS Benefits and Assistance Programs (Loans, Sickness, Maternity, Disability)

- 🌿 Local Government (LGU) Assistance Programs (Barangay, Municipality, City-Level Support)

- 🙋 Frequently Asked Questions About Government Assistance Programs in the Philippines

- 🌅 In Tough Times, Every Bit of Help Matters

- 📚 References

That’s why guides like this matter. The truth is, there are many government assistance programs available — for medical needs, education, livelihood, disasters, senior citizens, solo parents, and low-income households. The challenge is understanding which one fits your situation and how to apply without getting lost in the process.

This updated guide breaks everything down in simple, practical terms so you can see the benefits clearly, know if you’re eligible, and understand the steps to request help. No jargon. No confusing government language. Just real, usable information for Filipino families trying to get through tough times.

🌿 DSWD Assistance Programs (AICS, Medical, Funeral, Education)

The Department of Social Welfare and Development (DSWD) is the main government agency Filipinos turn to during urgent financial and medical crises. Whether it’s a sudden hospital bill, a death in the family, or a disaster that wipes out everything, DSWD’s AICS program helps families get immediate support.

What Assistance You Can Get

Medical Assistance

Helps cover:

- Hospital bills (inpatient/outpatient)

- Emergency room treatment

- Medicines

- Laboratory tests and diagnostics

- Chemotherapy, dialysis (case-by-case)

- Medical devices (wheelchair, crutches, etc.)

Burial Assistance

Financial help for:

- Funeral services

- Cremation

- Transport of remains

- Basic burial expenses

Educational Assistance

Supports students facing financial difficulty:

- Tuition assistance

- School supplies

- Transportation allowance

- Miscellaneous school fees

AICS (Assistance to Individuals in Crisis Situations)

Covers a wide range of crisis situations:

- Fire, flood, or accidents

- Illness or hospitalization

- Job loss

- Domestic abuse

- Abandonment

- Sudden emergencies affecting basic needs

Who Can Apply

DSWD prioritizes:

- Low-income families

- Senior citizens

- PWDs

- Solo parents

- Disaster victims

- OFWs in distress

- Students with urgent needs

- Individuals facing medical or financial emergencies

Note: You don’t have to be “extremely poor” to qualify — you just need a legitimate crisis.

Requirements (Common Documents)

Requirements vary by region, but typically include:

Basic Requirements

- Valid ID

- Barangay Certificate of Indigency

- Fully accomplished DSWD application form

Additional Requirements Depending on Assistance Type

- Medical: Hospital bill, medical abstract, prescription, doctor’s order

- Burial: Death certificate, funeral contract

- Education: School assessment form, registration form, student ID

- Calamity: Fire report, police blotter, or barangay certification

Tip: Always bring photocopies — DSWD rarely accepts digital copies.

Where to Apply

DSWD Central Office (Quezon City)

For NCR residents or higher-level cases.

DSWD Regional/Field Offices

Each region has its own office that handles AICS applications.

Satellite Action Centers / LGU Social Welfare Offices

Some municipalities and cities have DSWD desks to reduce long lines at regional offices.

Malasakit Centers (Inside Government Hospitals)

These centers house DSWD, PhilHealth, PCSO, and DOH — you can request assistance from multiple agencies in one place.

How to Avail (Step-by-Step Process)

Step 1: Go to the Nearest DSWD Office or Malasakit Center

Arrive early. Bring all required documents.

Step 2: Get a Queue Number and Fill Out a Screening Form

Provide your basic details and the type of assistance you’re requesting.

Step 3: Initial Verification

A staff member will check your eligibility and documents.

Step 4: Interview with a Social Worker

This determines:

- The nature of your crisis

- The amount of aid you qualify for

- Whether you need a Social Case Study Report

Step 5: Approval and Issuance of Assistance

You may receive:

- Cash assistance

- Guarantee letter (for hospitals, pharmacies, funeral homes)

- Food or material support

Step 6: Release / Payout

Some payouts are same-day; others are scheduled in the following days.

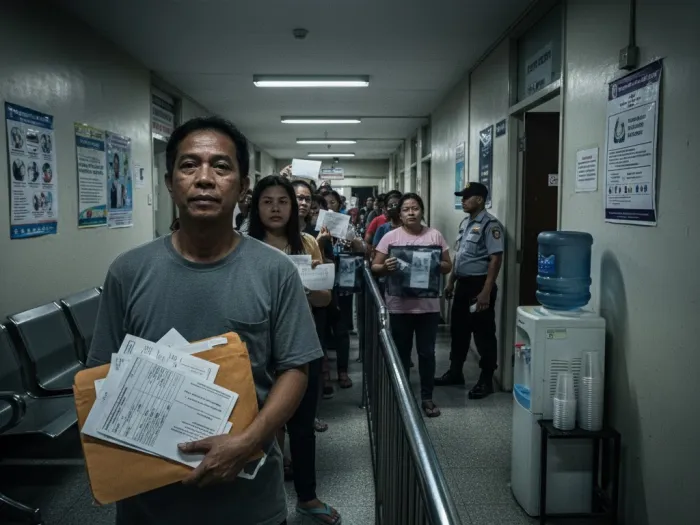

Important Tips (Real-World Experience)

- Lines can start as early as 5 AM in busy regions.

- Follow the official DSWD Facebook page of your region for schedules and announcements.

- Avoid fixers — DSWD assistance is free.

- Bring your own pen and envelope for organizing documents.

- Assistance is meant for genuine emergencies, not general financial support.

🌿 PhilHealth Benefits and Medical Coverage for Filipinos

PhilHealth is the national health insurance program that helps reduce medical expenses for all Filipinos. It doesn’t cover everything, but it significantly lowers hospital bills and provides access to essential healthcare services. Whether you’re employed, self-employed, or unemployed, PhilHealth is your first layer of medical protection.

What PhilHealth Covers

Inpatient Benefits

These apply when you are admitted to a hospital. Coverage includes:

- Room and board (ward-type rates)

- Medicines and supplies

- Diagnostic exams and laboratory tests

- Operating room services

- Professional fees (depending on case rate)

PhilHealth uses case rates — fixed amounts per illness, procedure, or condition. If your hospital bill exceeds the case rate, you pay the difference.

Outpatient Benefits

Covers select procedures such as:

- Day surgeries

- Dialysis sessions (up to 90 per year)

- Radiotherapy sessions

- Outpatient blood transfusion

Maternity Care Package

For normal delivery, C-section, and care for newborns. Coverage varies by facility type.

Z Benefits Package

For severe, long-term, or catastrophic illnesses including:

- Certain types of cancer

- Kidney transplants

- Coronary bypass

- Congenital conditions

These have strict eligibility guidelines but offer substantial coverage.

Konsulta Package

This is PhilHealth’s primary care program, providing:

- Routine checkups

- Screening exams

- Basic lab tests

- Preventive care

Konsulta is available through accredited health centers and clinics.

Who Is Eligible

Virtually all Filipinos are automatically eligible:

- Employed members

- Self-employed / voluntary members

- OFWs

- Senior citizens (automatic coverage)

- Indigents identified by DSWD

- Persons with Disability (PWDs)

- Lifetime members (retirees)

Requirements for Using PhilHealth

Basic documents include:

- PhilHealth ID or Member Data Record (MDR)

- PhilHealth Claim Form 1

- Updated premium contributions (for employed/self-employed)

- Valid ID

For dependents, you may need:

- Birth certificate

- Marriage certificate

- Proof of guardianship (if applicable)

Where You Can Use PhilHealth

Accredited Hospitals and Clinics Nationwide

Coverage applies to thousands of government and private hospitals across the country.

Malasakit Centers

PhilHealth desks are available inside these centers to process benefits quickly.

Konsulta Providers

Local clinics and health centers accredited under the Konsulta package.

How to Avail PhilHealth Benefits (Step-by-Step)

Step 1: Confirm Your Membership Status

Check your MDR or PhilHealth Konsulta registration.

Step 2: Submit PhilHealth Documents Upon Admission

Provide your:

- PhilHealth Claim Form 1

- PhilHealth ID

- MDR

Hospitals will verify your eligibility.

Step 3: Receive PhilHealth Deduction Before Discharge

The hospital automatically applies the case rate deduction to your bill.

Step 4: For Konsulta Services

Go to your registered Konsulta provider and present your PhilHealth ID.

Tip: Always ensure your PhilHealth contributions are updated, especially if self-employed.

Common Limitations You Should Know

PhilHealth does not cover:

- Full private room costs

- Professional fees that exceed case rates

- Many outpatient diagnostics

- Dental procedures (except surgical)

- Non-accredited hospitals

This is why PhilHealth should be paired with an HMO or additional support from agencies like DSWD or PCSO.

🌿 PCSO Medical Assistance Program (Guarantee Letters, Hospital Support)

The Philippine Charity Sweepstakes Office (PCSO) provides financial support for Filipinos facing costly medical treatments. Their program focuses on illnesses and procedures that often overwhelm family budgets — surgeries, confinement, dialysis, chemotherapy, and emergency care. If your hospital bill is too heavy even after PhilHealth and HMO deductions, PCSO is one of the strongest agencies to seek help from.

What PCSO Covers

Inpatient and Outpatient Medical Assistance

PCSO may help pay for:

- Hospital confinement

- Emergency care

- Surgeries and operations

- Intensive care treatment

- Chemotherapy

- Dialysis

- Cardiac procedures

- Laboratory and diagnostic exams

Assistance for Medical Devices

Examples include:

- Pacemakers

- Hearing aids

- Prosthetics

- Implants

- Other specialized equipment

Guarantee Letters

Instead of cash, PCSO often issues a Guarantee Letter (GL) addressed to the hospital or clinic, stating the amount PCSO will shoulder.

This is extremely useful because hospitals accept the GL as partial payment.

Who Can Apply

PCSO does not require you to be indigent. You may apply if you:

- Cannot afford medical treatment

- Have a serious or critical illness

- Need continuous treatment (chemo, dialysis)

- Are a senior citizen or PWD with medical needs

- Are a patient in a government or private hospital

- Already used PhilHealth but still have a large remaining balance

Almost anyone with a legitimate medical need can apply.

Requirements (Common)

Primary Documents

- Patient’s valid ID

- Request letter addressed to PCSO

- Barangay Certificate of Indigency (not always required)

- Authorization letter if filing for someone else

Medical Documents

- Medical abstract

- Prescription from attending doctor

- Treatment plan

- Surgical estimate or procedure cost

- Updated hospital bill

- Quotation for medical devices (if applicable)

For Dialysis / Chemo / Long-Term Treatment

- Treatment schedule

- Previous session receipts

- Updated medical records

Important: Always bring photocopies. PCSO rarely accepts digital copies.

Where to Apply

PCSO Main Office – Mandaluyong City

Ideal for NCR residents or major requests.

PCSO Branch Offices (Nationwide)

Every province has at least one PCSO branch that accepts walk-in requests.

Hospitals with PCSO Desks

Some government hospitals have PCSO windows inside, making processing faster.

How to Avail (Step-by-Step Guide)

Step 1: Visit the PCSO Office or Hospital Desk

Go early to avoid long queues.

Step 2: Secure the Queue Number and Application Slip

Provide patient details and type of assistance needed.

Step 3: Submit Documents for Verification

Staff will check medical and financial documents to see if you qualify.

Step 4: Interview with PCSO Staff

This determines:

- Your eligibility

- Amount you may receive

- Whether a Guarantee Letter or cash assistance will be issued

Step 5: Issuance of Guarantee Letter or Schedule of Release

- Guarantee Letter goes directly to the hospital

- Cash assistance (for certain cases) is released through PCSO cashier

Step 6: Hospital Applies the GL to Your Bill

Your bill is reduced by the amount stated in the GL.

Important Tips (Real-World Advice)

- PCSO rarely gives full coverage; they provide partial assistance.

- For major operations, combine PhilHealth + PCSO + DSWD + LGU for maximum support.

- The Guarantee Letter can only be used in the hospital indicated — not elsewhere.

- Cash aid is limited and often prioritized for small emergencies.

- Keep copies of all bills and receipts. PCSO may ask for them.

This program is a huge help for families facing high hospital costs, especially during long-term treatments like dialysis and chemotherapy.

🌿 Pag-IBIG Benefits and Assistance Programs (Housing, Calamity, MP2 Savings)

Pag-IBIG isn’t just about housing loans. It’s one of the most flexible government programs that helps Filipinos with savings, shelter, and emergency assistance. Whether you’re building a home, recovering after a typhoon, or simply trying to grow your savings securely, Pag-IBIG is one of the best places to look.

What Pag-IBIG Offers

Housing Loan Program

Pag-IBIG provides some of the lowest interest rates for home financing in the Philippines, covering:

- Lot purchase

- House construction

- House improvement

- Refinancing of existing mortgages

- Purchase of condo units or townhouses

Long repayment terms (up to 30 years) make this ideal for low- to middle-income families.

Multi-Purpose Loan (MPL)

A quick cash loan meant for immediate needs like:

- Tuition

- Medical bills

- Home repairs

- Utility bills

- Small emergencies

Borrow up to 80% of your total savings, repayable in 24 or 36 months.

Calamity Loan

For members affected by natural disasters such as:

- Typhoons

- Floods

- Earthquakes

- Landslides

- Volcanic eruptions

Interest is lower than regular loans, and processing is faster.

MP2 Savings Program

A high-dividend savings program offering:

- 5-year term

- Tax-free dividends

- Government-backed security

- Flexible contributions (no maximum limit)

This is popular among OFWs, retirees, and Filipinos aiming for mid-term wealth building.

Who Can Apply

Any active Pag-IBIG member:

- Employed workers

- Self-employed and freelancers

- OFWs

- Voluntary members

- New members with at least 24 monthly contributions (for loans)

Requirements (Common)

For Housing Loan

- Valid IDs

- Proof of income

- Completed Housing Loan Application

- Transfer Certificate of Title (TCT) or condo documents

- Tax declarations

- Building plans (for construction loans)

For MPL / Calamity Loan

- Pag-IBIG Loyalty Card Plus or two IDs

- Loan application form

- Proof of income

- Barangay Certificate (for calamity loan)

For MP2 Savings

- Valid ID

- MP2 enrollment form

- Pag-IBIG MID Number

Where to Apply

Pag-IBIG Branches Nationwide

Loans and MP2 can be processed at any Pag-IBIG office.

Virtual Pag-IBIG (Online Portal)

Perfect for loan applications and MP2 enrollment without going to an office.

You can:

- Apply for Housing Loan

- Apply for MPL / Calamity Loan

- Enroll in MP2

- Check your contributions

Employer HR Office (for employees)

Some employers process MPL applications in bulk.

How to Avail (Step-by-Step Guide)

Step 1: Check Your Membership Status

Ensure contributions are complete and updated.

Step 2: Prepare Required Documents

Different programs require different sets of documents.

Step 3: Apply Online or Visit a Pag-IBIG Branch

- Online: Virtual Pag-IBIG is the fastest route

- Branch: Prepare photocopies and original documents

Step 4: Wait for Evaluation and Approval

Housing loans take longer (1–2 months). MPL and Calamity loans are approved much faster.

Step 5: Receive Loan Proceeds or Start Savings

- Loans go through your Loyalty Card or bank

- MP2 contributions can be done online or via partner channels

Important Tips

- If you plan to borrow in the future, never miss monthly contributions.

- MP2 is best when kept for the full 5-year term for higher returns.

- Apply for MPL and Calamity Loan online to avoid long branch lines.

- Housing loan applicants should secure complete property documents early — this is the #1 cause of delays.

Pag-IBIG is one of the most versatile government programs, combining savings, housing, and emergency relief in one membership.

🌿 SSS Benefits and Assistance Programs (Loans, Sickness, Maternity, Disability)

The Social Security System (SSS) provides financial protection for private-sector workers, self-employed individuals, and voluntary members. These benefits act as a safety net during illness, job loss, disability, retirement, and other life events that affect your income. For many Filipinos, SSS is the second most important institution next to PhilHealth.

What SSS Offers

Salary Loan

A short-term loan for immediate needs such as:

- Bills

- Tuition

- Emergency expenses

- Minor home repairs

Borrow:

- 1-month salary loan

- 2-month salary loan (if eligible)

Repayment: 24 months through employer or voluntary payment.

Sickness Benefit

A daily cash allowance for members who cannot work due to illness or injury.

Requirements:

- At least 4 days of sickness

- Medical certificate

- Employer notification (for employed)

Maternity Benefit

Cash benefit for female members who are pregnant or had a miscarriage/emergency termination.

Covers:

- Normal delivery

- C-section

- Miscarriage

- Ectopic pregnancy

You must notify SSS early in the pregnancy.

Unemployment Benefit

A cash payout if you lose your job due to:

- Company retrenchment

- Closure

- Redundancy

- Installation of labor-saving devices

Cash benefit: Up to 10,000 pesos per month for 2 months (depending on salary credit).

Disability Benefit

For permanent partial or total disabilities such as:

- Loss of limb

- Blindness

- Permanent illness

- Severe physical injury

Can be a monthly pension or a lump-sum amount.

Retirement Benefit

A monthly pension (or lump sum) given once you reach retirement age with enough contributions.

Who Can Apply

All active SSS members:

- Private employees

- Self-employed

- Voluntary members

- OFWs

- Non-working spouses (if registered)

Each benefit has specific requirements, but membership is the foundation.

Requirements (Common)

For Loans

- Valid ID

- SSS number

- Updated contributions

- Fully completed online form (via My.SSS)

For Sickness

- Medical certificate

- SSS-approved forms

- Hospital records (if any)

For Maternity

- Pregnancy notification form

- Proof of pregnancy

- Delivery documents

For Unemployment

- Certificate of separation

- Dismissal documents

- Company-issued notice

For Disability

- Medical records

- Disability assessment

- Supporting documents depending on the condition

Where to Apply

My.SSS Online Portal (Most Convenient)

You can apply for:

- Salary Loan

- Maternity Benefit

- Unemployment Benefit

- Sickness Reimbursement

- Contribution verification

SSS Branches Nationwide

For disability, complex claims, and cases requiring in-person verification.

Employer HR Office

For employees filing sickness or maternity notifications.

How to Avail SSS Benefits (General Step-by-Step)

Step 1: Log In to My.SSS

Create an account if you don’t have one.

Step 2: Select the Benefit or Loan You Need

Upload required documents.

Step 3: Wait for Evaluation

Processing time varies:

- Loans: 1–5 days

- Maternity: 5–7 days

- Unemployment: 5–10 days

- Sickness: 7–15 days

Step 4: Receive the Benefit

Payout goes to:

- Bank account

- UMID-ATM linked account

Step 5: For Employer-Related Benefits

Your employer must confirm your application online.

Important Tips

- Always keep contributions up to date — many benefits require a minimum number of payments.

- Salary loans reduce your future SSS benefits if unpaid.

- For unemployment benefit, apply within one year of job loss.

- For maternity, notify SSS immediately after confirming pregnancy.

- Disability claims take longer — prepare complete and detailed medical documents.

SSS provides cash aid during critical moments, helping Filipino workers survive sickness, job loss, and life-changing emergencies.

🌿 Local Government (LGU) Assistance Programs (Barangay, Municipality, City-Level Support)

Local government units (LGUs) are often the fastest and most accessible source of assistance when families face sudden emergencies. Unlike national agencies with long queues, LGUs can provide immediate help through your barangay, municipal/city hall, or provincial government. Many Filipinos don’t know how much support is available locally until they actually need it.

What LGU Assistance Usually Includes

Medical Assistance

Most LGUs offer financial assistance for:

- Hospital bills

- Medicines

- Laboratory tests

- Emergency room treatment

- Medical certificates

- Ambulance assistance

- Health center services (checkups, vaccines, prenatal care)

Provinces and cities often have stronger medical programs than municipalities, especially those with public hospitals.

Burial and Funeral Assistance

LGUs may help with:

- Funeral expenses

- Cremation fees

- Transport of remains

- Caskets (in some municipalities)

- Financial support for indigent families

This is often faster to process compared to national agencies.

Educational Assistance

City/municipal governments commonly support students through:

- Scholarship programs

- Allowances

- School supply distribution

- College financial aid

- Cash incentives for honor students

Some LGUs also offer SPES, a summer job program for students.

Senior Citizen and PWD Benefits

LGUs typically provide:

- Social pension (for qualified seniors)

- Discounts and priority lanes

- Birthday gifts or cash incentives

- Medical allowances

- Assistive devices (wheelchairs, canes)

- PWD financial subsidies

Livelihood and Cash-For-Work Programs

These include:

- Small business starter kits

- Training for livelihood

- Cash-for-work during community cleanups

- Assistance to solo parents

- Women’s livelihood programs

Many LGUs partner with DTI and DOLE for broader livelihood opportunities.

Calamity and Disaster Assistance

During disasters, LGUs are the first to respond with:

- Food packs

- Water and hygiene kits

- Temporary shelter

- Relocation support

- Emergency cash assistance

- Repair materials (GI sheets, plywood, nails)

Who Can Apply

Eligibility depends on the LGU, but priority typically includes:

- Indigent families

- Solo parents

- PWDs

- Senior citizens

- Students from low-income households

- Victims of calamities

- Individuals with medical emergencies

Your barangay often plays a major role in verifying eligibility.

Requirements (Common Documents)

Basic Requirements

- Valid ID

- Barangay Certificate of Indigency

- Application form (from city/municipal hall)

Depending on Assistance Type

- Medical: Hospital bill, prescription, medical abstract

- Burial: Death certificate, funeral contract

- Education: School registration or assessment form

- Calamity: Fire report, barangay damage certificate, photos

- Livelihood: Business plan or training certificates

Bring photocopies and originals for validation.

Where to Apply

Barangay Hall

For initial screening, indigency certificates, and referrals.

Some barangays also provide small emergency cash aid.

City / Municipal Social Welfare and Development Office (MSWDO)

Handles most LGU-based assistance programs.

Mayor’s Office or Governor’s Office

Some recipients request help directly through the mayor or governor’s extension office.

City Health Office or Local Hospital

For medical support or medicine requests.

Public Employment Service Office (PESO)

For livelihood, job programs, and student employment.

How to Avail LGU Assistance (Step-by-Step)

Step 1: Go to the Barangay Hall

Request a Barangay Certificate of Indigency or Referral Letter.

This is almost always required.

Step 2: Visit MSWDO or the Appropriate LGU Office

Bring all your documents.

Offices include:

- Social Welfare Office (medical, burial, social aid)

- City Health Office (medical, vaccines, screenings)

- PESO (livelihood, employment)

- Mayor/Governor’s Office (direct assistance)

Step 3: Fill Out the Application Form

Provide accurate details about your situation.

Step 4: Submit Your Documents for Screening

A staff member will verify completeness and eligibility.

Step 5: Interview with Social Worker (If Required)

This helps determine the type and amount of assistance to be granted.

Step 6: Wait for Approval and Release

Assistance may be given as:

- Cash

- Guarantee letter

- Food packs

- Medicine kits

- Relief goods

- Shelter materials

Processing time can range from same-day release to a few days depending on the LGU.

Important Tips

- LGUs respond faster during emergencies than national agencies.

- Always be polite; many LGU staff manage heavy workloads.

- Follow official FB pages for announcements and schedules.

- Some LGUs require residency of at least 6 months to 1 year.

- Avoid fixers — assistance is free for all qualified residents.

LGUs are the closest level of government to the people, and they often provide help faster and more personally than national agencies. Many Filipinos don’t realize how much assistance their local government can offer until they finally request it.

🙋 Frequently Asked Questions About Government Assistance Programs in the Philippines

• What’s the easiest government assistance program to apply for?

For emergencies, the fastest is usually LGU assistance through your barangay or city hall. DSWD AICS is next, but lines can be long. For medical support in hospitals, Malasakit Centers are the quickest because multiple agencies (DSWD, PhilHealth, PCSO) are inside one location.

• Can I apply to multiple government agencies for the same problem?

Yes. Many families combine PhilHealth + PCSO + DSWD + LGU support for big medical bills. Agencies are aware that one program alone usually isn’t enough. Just avoid claiming the exact same receipt twice.

• Do I need to be indigent to receive assistance?

Not always. While indigent families are prioritized, any Filipino in crisis may qualify — like sudden hospitalization, job loss, or disasters. PCSO, DSWD, and LGUs often help middle-income families facing heavy medical bills.

• How long does it take to get DSWD assistance?

AICS may be released same day or within 3–7 days, depending on the region and volume of applicants. Calamity-related assistance is usually faster, while medical assistance sometimes requires more documents.

• Does PhilHealth cover everything during hospitalization?

No. PhilHealth provides partial coverage through fixed case rates. You will still need to pay the remaining balance or use an HMO, PCSO, DSWD, or LGU aid to fill in the gaps.

• How much can PCSO shoulder for medical bills?

Amounts vary, but many hospitals accept ₱5,000–₱50,000 Guarantee Letters depending on the case. Major surgeries or long-term treatments like dialysis may qualify for higher assistance.

• What’s the best assistance program during typhoons or disasters?

Your LGU is the fastest responder. They provide food packs, cash-for-work, shelter materials, and immediate financial aid. DSWD follows with family kits and emergency cash. For damaged homes, you may also use Pag-IBIG Calamity Loan.

• Can OFWs get government assistance?

Yes. OFWs can access:

- OWWA benefits (medical, livelihood, education)

- Pag-IBIG loans and MP2

- SSS benefits

- DSWD assistance (for repatriation or crisis)

• Do government offices require personal appearance?

For many programs, yes. DSWD, PCSO, LGUs, and some PhilHealth services require in-person visits. But Pag-IBIG and SSS have strong online portals, making many applications possible from home.

• What documents do I always need to prepare?

Almost all agencies require:

- Valid ID

- Barangay Certificate of Indigency or Residency

- Proof of your situation (hospital bill, fire report, school papers, etc.)

- Application form

Keeping a folder of updated documents helps make applications faster.

🌅 In Tough Times, Every Bit of Help Matters

Life in the Philippines isn’t easy, especially when emergencies hit without warning. A hospital bill, a fire, a job loss, a sudden school expense — any of these can shake even the most disciplined family budget. But you’re not alone. The programs we’ve covered here exist for exactly those moments when you need support the most.

Government assistance isn’t charity. It’s a safety net designed so Filipino families have a fighting chance to recover, rebuild, and breathe again. Whether it’s DSWD stepping in during a medical crisis, PCSO helping with hospital bills, Pag-IBIG offering loans or savings options, or your LGU responding right away after a disaster, every layer of support makes the burden lighter.

You don’t need to master every program at once. What matters is knowing where to turn when life gets heavy. With the right information and complete documents, you can access real help when your family needs it the most — and slowly build back your stability with confidence.

📚 References

DSWD – Assistance to Individuals in Crisis Situations

PCSO – Medical Assistance Program

Pag-IBIG Fund – Loans & MP2 Savings