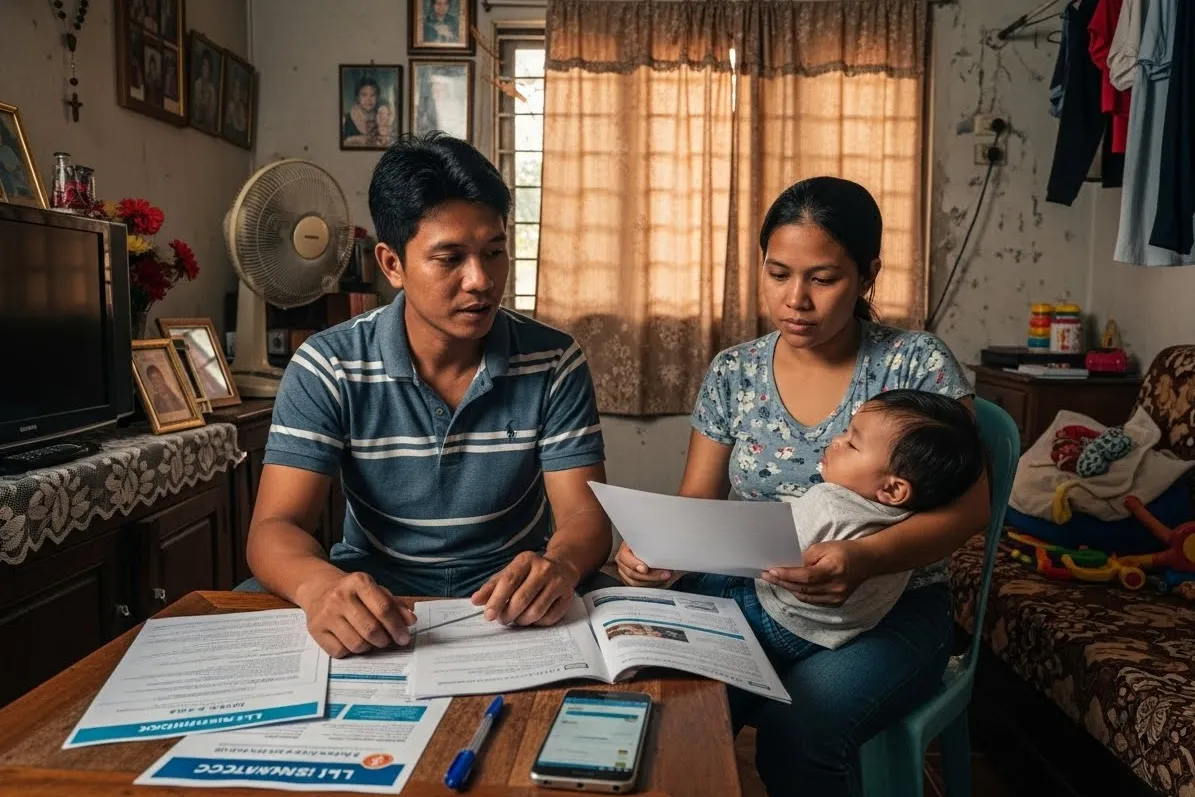

Filipinos don’t usually talk about life insurance openly. It feels scary, overwhelming, or too “pang-mayaman.” But the truth is simpler: life insurance is just protection — protection for your family, your kids, and the people who rely on you. And when something happens, it’s often the only thing that keeps them financially steady instead of struggling.

- 🌿 Why Life Insurance Matters for Filipino Families

- 🌿 Types of Life Insurance in the Philippines (Explained Simply for Beginners)

- 🌿 Best Life Insurance Plans in the Philippines

- 📊 Comparison Table: Coverage, Premiums, and Ideal Users

- 🌿 How to Choose the Right Life Insurance

- ⚠️ Red Flags to Avoid When Buying Life Insurance

- 🌿 How Much Life Insurance You Need (Simple Formula for Filipinos)

- 🌿 How Much Does Life Insurance Cost in the Philippines?

- 🌿 How to Get Life Insurance in the Philippines (Step-by-Step)

- 🙋 Frequently Asked Questions About Life Insurance in the Philippines

- 🌅 Protection Today, Peace Tomorrow

- 📚 References

That’s why many people search for the best life insurance in the Philippines. Not because they expect something bad to happen, but because they want peace of mind. They want clarity. They want to understand what plan fits their budget and their needs, without the pressure or sales talk.

This guide breaks everything down gently and practically — the policy types, coverage options, premiums, and how to choose what works for beginners and families. No jargon. No confusing charts. Just straightforward guidance for real Filipino households trying to protect what matters most.

🌿 Why Life Insurance Matters for Filipino Families

Many Filipinos delay getting life insurance because it feels unnecessary — until life reminds us why protection matters. A medical emergency, sudden loss of income, or an unexpected accident can instantly shake a family’s financial foundation. And when that happens, the burden often falls on loved ones who are already doing their best to get by.

Life insurance isn’t about expecting tragedy. It’s about preparing so that the people you care about don’t suffer financially if something happens to you. It gives your family the space to breathe, grieve, and stay afloat without scrambling for loans, selling property, or relying on relatives.

It Replaces Lost Income

If you’re the breadwinner or contribute to household expenses, life insurance ensures your family can still cover:

- Monthly bills

- Tuition fees

- Groceries

- Rent or mortgage

- Everyday needs

It acts like a safety net that catches them when life suddenly shifts.

It Protects Dreams and Long-Term Plans

Your income isn’t just for survival — it supports future goals.

Life insurance helps:

- Keep kids in school

- Continue house payments

- Fund long-term plans even if you’re gone

It makes sure your goals don’t disappear just because you’re not there to fund them.

It Shields Your Family from Debt

Many Filipino households fall into deep debt when emergencies strike.

Life insurance can cover:

- Medical bills

- Funeral expenses

- Outstanding loans

Instead of borrowing from relatives or lenders, your family gets immediate financial support.

It Provides Emotional and Financial Stability

When tragedy happens, the last thing your loved ones need is financial stress on top of grief. Insurance gives them breathing room to process emotions without worrying about money right away.

Life insurance is not an expense. It’s protection — and for many families, it’s the quiet foundation that keeps them steady during their hardest moments.

🌿 Types of Life Insurance in the Philippines (Explained Simply for Beginners)

Life insurance only feels confusing because the terms sound technical. But underneath the jargon, there are just a few main types — each designed for different needs, budgets, and stages of life. Once you understand these, choosing becomes much easier.

Term Life Insurance

This is the simplest and most affordable type.

- Coverage lasts for a set number of years (10, 20, or 30 years)

- You pay lower premiums

- No cash value or investment component

- Pure protection

Best for: budget-conscious families, OFWs, breadwinners, or anyone who wants maximum coverage at low cost.

Whole Life Insurance

This policy gives lifetime coverage (usually up to age 100).

- More expensive but permanent

- Has cash value that grows over time

- Premiums stay the same for life

Best for: long-term planners who want stable, guaranteed protection plus savings.

VUL (Variable Universal Life)

This is life insurance + investment combined.

- Part of your premium pays for insurance

- The rest goes into investment funds (equity, bond, balanced)

- Cash value grows based on market performance

- Flexible premiums

Best for: people who want insurance and are comfortable investing — but it’s pricier and performance varies.

Health Insurance / Critical Illness Riders

Not exactly “life insurance,” but often paired with it.

- Provides cash benefit if diagnosed with major illnesses

- Helps cover medical or treatment costs

- Can be added to term, whole life, or VUL policies

Best for: families worried about rising healthcare expenses.

Group Life Insurance

Offered by employers or cooperatives.

- Very affordable

- Basic protection

- Coverage ends when you leave the job or group

Best for: employees who want temporary supplemental coverage.

Microinsurance

For those with very limited budgets.

- Very low premiums

- Lower coverage amounts

- Simple, practical protection

Best for: students, minimum-wage earners, small business owners, or anyone starting with a tight budget.

Each type exists because Filipinos have different financial realities. What works for a young professional is different from what a parent of three might need. Understanding these categories is the first step to choosing wisely.

🌿 Best Life Insurance Plans in the Philippines

Choosing the “best” life insurance isn’t about picking the most expensive plan or the company with the loudest ads. It’s about matching your needs, your budget, and your stage in life to a policy that gives the right kind of protection. Here’s a beginner-friendly overview of strong options from reputable providers in the Philippines.

Term Life Insurance (Best for Affordable High Coverage)

AIA – AIA Life Protect

- High coverage for low premiums

- Flexible terms (10, 20, 25 years)

- Optional critical illness riders

Manulife – Term Life Protect

- Affordable starter plan

- Renewable and convertible

- Ideal for families wanting pure protection

Sun Life – Sun Safer Life

- Simple terms

- Can be upgraded later

- Good entry-level coverage

Whole Life Insurance (Best for Lifetime Protection)

Sun Life – Sun LifeAssure

- Lifetime coverage

- Built-in critical illness benefit

- Stable long-term plan

PRU Life UK – PRUWellness or PRULife Prime

- Flexible payment options

- Guaranteed lifetime protection

- Growing cash value over time

VUL Insurance (Best for Insurance + Investment)

Sun Life – Sun Maxilink Prime

- Balanced insurance and investment

- Premiums can be increased anytime

- Good for long-term wealth building

AIA – AIA Future Builder / AIA Aspire

- Strong fund options

- Ideal for young professionals

- Long-term growth potential

PRU Life UK – PRULink Assurance Account Plus

- Highly flexible VUL

- Wide fund selection

- Designed for long-term financial goals

Microinsurance (Best for Tight Budgets)

CocoLife Micro-Insurance Plans

- Extremely low premiums

- Straightforward benefits

- Simple application

CARD MBA Microinsurance

- Designed for low-income families

- Community-based support

- Affordable protection

Group Life Insurance (Offered Through Employers)

Sun Life GREPA Group Life Plans

- Very low cost

- Good supplemental protection

- Coverage tied to employment

These are not ranked by “best,” because the best plan depends entirely on your needs and budget. But all options listed here come from reputable companies with strong financial strength — a crucial factor when choosing life insurance.

📊 Comparison Table: Coverage, Premiums, and Ideal Users

To make choosing easier, here’s a simplified comparison of common life insurance types and which kind of Filipino each one fits best. Instead of listing every company, this table focuses on policy types so you can quickly see what matches your needs and budget.

| Insurance Type | Typical Coverage | Approx. Premium Range | Best For |

|---|---|---|---|

| Term Life Insurance | ₱1M–₱5M coverage (pure protection) | ₱3,000–₱15,000 per year | Breadwinners, OFWs, young families, budget-conscious beginners |

| Whole Life Insurance | Lifetime coverage + cash value | ₱20,000–₱60,000 per year | Long-term planners, parents, those who want guaranteed protection |

| VUL (Insurance + Investment) | Insurance + variable growth | ₱30,000–₱80,000 per year | Young professionals, those wanting insurance + long-term investing |

| Health/Critical Illness Insurance | Lump-sum illness benefit | ₱10,000–₱40,000 per year | Families with high medical expenses, adults in their 30s–50s |

| Microinsurance | ₱50,000–₱200,000 coverage | ₱1–₱20 per day | Students, low-income earners, sari-sari owners, solo parents |

| Group Life Insurance | Employer-based coverage | Often free or very low cost | Employees needing supplemental protection |

This table helps you see the big picture so you can confidently match a policy type to your current life stage and budget.

🌿 How to Choose the Right Life Insurance

Life insurance isn’t a one-size-fits-all product. The right plan depends on your income, responsibilities, goals, and how you feel about risk. Before you get overwhelmed by quotes and sales talk, here’s a clear way to choose a policy that genuinely fits your life.

Identify Your Main Purpose

Start by asking yourself what you want the policy to do:

- Replace your income if something happens?

- Protect your kids’ education?

- Cover medical emergencies?

- Build long-term wealth?

Your answer tells you what policy type makes sense.

For pure protection, choose term.

For lifetime coverage, choose whole life.

For protection plus investments, choose VUL.

Decide How Much Coverage You Need

A common rule is 10 times your annual income.

If you earn ₱300,000 a year, aim for around ₱3,000,000 in coverage.

This helps your family maintain their lifestyle without going into debt.

If 10x your income feels too high or too expensive, start with what you can afford and increase later.

Set a Budget That Doesn’t Hurt Your Monthly Cash Flow

Life insurance should protect your family, not pressure your wallet.

A good guideline:

- Keep premiums at 5% to 10% of your annual income

- Or choose a fixed amount you’re comfortable with

If you feel strained paying it, the plan is too big for your situation.

Consider Your Age and Stage in Life

Your needs change as life changes:

- 20s: cheaper premiums, great time to lock coverage

- 30s: ideal for term or VUL for family protection

- 40s–50s: consider health riders and whole life coverage

- Parents: prioritize income replacement and education protection

The younger you are, the cheaper your premiums.

Check the Insurance Company’s Strength

Insurance is a long-term promise. Choose companies that are:

- Financially stable

- Well-capitalized

- Highly trusted

- With decades-long track records

This ensures they’ll still be around when your family needs them.

Understand What’s Included (and What’s Not)

Many Filipinos buy insurance without fully understanding:

- Exclusions

- Waiting periods

- Optional riders

- Surrender fees

- Cash value projections

Ask questions. Read the details. Protection works only if you know what you’re getting.

Work With a Trustworthy Financial Advisor

A good advisor guides you — not pressures you.

Look for someone who:

- Explains clearly

- Gives realistic projections

- Understands your goals

- Respects your budget

You should feel comfortable, not overwhelmed.

Choosing life insurance doesn’t have to be scary. With the right approach, you can pick a plan that protects your family and gives you peace of mind for years to come.

⚠️ Red Flags to Avoid When Buying Life Insurance

Life insurance can protect your family — but only if you get the right plan from the right people. Many Filipinos end up disappointed not because insurance is bad, but because they were misled, rushed, or sold something they didn’t fully understand. Here are the warning signs you should always watch out for.

“Guaranteed High Returns” Promises

If the agent says your money will grow fast and guaranteed, that’s a red flag.

Returns from VULs, investments, or funds are never guaranteed. They rise and fall with the market. Only term or whole life coverage is guaranteed — investments are not.

Pressure Tactics or Sales Push

If an advisor rushes you into signing today “kasi last day promo” or “mataas pa health mo ngayon,” walk away.

Good advisors give you time to think, ask questions, and compare options.

Unclear Explanation of Fees

Every policy has fees:

- Insurance charges

- Fund management fees

- Withdrawal or surrender charges

- Rider fees

If they can’t explain fees clearly, that’s a problem.

No Discussion of Coverage Amount

Some agents focus on investments without even calculating your actual protection needs.

If they don’t ask about your income, dependents, or financial goals, they’re not helping — they’re just selling.

Vague or Missing Policy Illustrations

An illustration shows:

- Premium breakdown

- Projected cash values

- Insurance charges

- Guaranteed vs. non-guaranteed benefits

If they avoid showing it, or refuse to send it in writing, that’s a major red flag.

Unrealistic Projections

If an agent shows you projections assuming very high rates (like 12–20% returns), be cautious. Projections should be realistic, conservative, and aligned with long-term market performance.

Not Discussing Exclusions

Every policy has exclusions (suicide clause, pre-existing conditions, etc.).

If they skip these topics, you risk future claim issues.

No Official Receipts or Official Application Links

Avoid anyone who:

- Accepts payments via personal accounts

- Doesn’t register you through official portals

- Doesn’t provide receipts or policy numbers

Insurance must always be processed through legitimate, traceable channels.

Poor Track Record or No License

Ask for their license number. All licensed financial advisors can provide it.

Those who refuse or make excuses are a red flag.

Avoiding these issues ensures you buy protection you understand, trust, and can actually rely on.

🌿 How Much Life Insurance You Need (Simple Formula for Filipinos)

Many Filipinos get underinsured because they only buy what “fits the budget,” not what their family actually needs. But there’s a simple way to calculate the right amount of coverage without getting overwhelmed or relying on guesswork.

Use the 10x Income Rule

This is the easiest and most practical method for most households.

- If you earn ₱300,000 per year, aim for ₱3,000,000 in coverage.

- If you earn ₱500,000 per year, aim for ₱5,000,000.

This ensures your family can maintain their lifestyle for years even if something happens to you.

Add Your Major Financial Obligations

Beyond income replacement, consider your big responsibilities:

- Outstanding loans or credit cards

- Tuition for kids

- Mortgage or rent

- Daily living expenses

A simple rule: add the total amount you would want your family to receive to fully cover these obligations.

Factor In Your Age and Health

Younger applicants get lower premiums and higher approval chances.

If you’re in your 20s or 30s, lock in coverage now before your health changes.

If you’re in your 40s or 50s, prioritize essential coverage first, then add riders if the budget allows.

Consider Your Family Setup

Your beneficiaries matter:

- Single with no dependents: minimal coverage + health protection

- Married with kids: prioritize high coverage term plans

- Single parent: consider term insurance + critical illness

- Breadwinner: aim for maximum coverage with affordable premiums

Your dependents determine how much protection you should aim for.

Adjust Based on Your Budget

If the ideal coverage feels too expensive, don’t pressure yourself.

Start with what you can afford:

- Even ₱1M coverage is better than none

- You can always upgrade later

- Your first goal is to secure basic protection

The perfect plan is the one you can maintain consistently.

Calculating your coverage isn’t about perfection — it’s about making sure your family is protected during the hardest moments. Even a modest policy can make a huge difference.

🌿 How Much Does Life Insurance Cost in the Philippines?

Life insurance isn’t as expensive as many Filipinos imagine. In fact, most people are surprised at how affordable basic protection can be once they see the numbers. The cost depends on age, coverage amount, policy type, and health — but here’s a practical look at what you can expect.

Term Insurance (Most Affordable Option)

Term life offers the highest coverage for the lowest price.

Typical premium range:

- ₱2,000 to ₱10,000 per year

- Coverage from ₱1M to ₱5M

This is ideal for breadwinners, OFWs, young families, and anyone who wants strong protection without the high cost.

Whole Life Insurance (Lifetime Coverage)

Premiums are higher because the policy builds cash value and lasts for life.

Typical premium range:

- ₱20,000 to ₱60,000 per year

- Coverage varies depending on the plan

Whole life works best for long-term planners and those who want guaranteed, permanent protection.

VUL Insurance (Insurance + Investment)

VULs have higher premiums because part of your payment goes to investments.

Typical premium range:

- ₱30,000 to ₱80,000 per year

- Cash value depends on market performance

Good for Filipinos who want life protection and are comfortable with long-term investing.

Health or Critical Illness Riders

These are add-ons to a main policy.

Typical premium range:

- ₱10,000 to ₱40,000 per year

- Coverage depends on illness type and benefit amount

Useful if you want extra protection from medical emergencies.

Microinsurance

Very low-cost daily or monthly contributions.

Typical premium range:

- ₱100 to ₱300 per month

- Coverage is smaller but practical

Ideal for students, minimum-wage earners, and families on a tight budget.

Age Makes a Big Difference

• A 25-year-old pays much less than a 40-year-old.

• Health affects premiums too — pre-existing conditions can increase costs or limit options.

Your Budget Should Still Be the Guide

A good rule:

- Keep premiums around 5% to 10% of your annual income.

Choose a policy that won’t pressure your monthly cash flow. Protection should feel manageable, not stressful.

With the right type of plan, life insurance can be affordable, practical, and deeply valuable for Filipino families.

🌿 How to Get Life Insurance in the Philippines (Step-by-Step)

Getting life insurance can feel overwhelming at first, especially if it’s your first time talking to an advisor or comparing plans. But the process is actually simple once you break it down. Here’s a beginner-friendly roadmap to help you move with confidence.

Step 1: Assess Your Needs and Budget

Before talking to any agent, be clear about:

- Your monthly budget

- Your goals (family protection, future savings, health coverage)

- Your desired coverage amount

- Your dependents and responsibilities

This keeps you focused and prevents you from being sold something too expensive.

Step 2: Choose the Type of Insurance

Decide whether you need:

- Term (pure protection, most affordable)

- Whole life (lifetime coverage + cash value)

- VUL (insurance + investment)

- Microinsurance (budget-friendly starter protection)

Knowing this upfront makes comparing plans easier.

Step 3: Talk to a Licensed Financial Advisor

A licensed advisor will help explain options, run computations, and present official illustrations. Make sure they:

- Clearly discuss benefits AND limitations

- Show policy details in writing

- Respect your budget

- Answer your questions without pressure

Trust your gut — if someone feels pushy, find another advisor.

Step 4: Compare Quotes and Policy Illustrations

Review:

- Coverage amount

- Premium cost

- Payment terms (annual, quarterly, monthly)

- Cash value projections

- Riders included

- Exclusions

Take your time. Life insurance is a long-term decision.

Step 5: Complete the Application Form

You’ll fill out forms about your:

- Personal details

- Health history

- Occupation

- Lifestyle

Be honest. Misleading information can affect future claims.

Step 6: Undergo Medical Evaluation (If Required)

Some plans require:

- Medical exam

- Blood tests

- Questionnaire

- Health verification

Healthy applicants usually get better premiums.

Step 7: Wait for Approval

Approval can take a few days to a few weeks depending on:

- Medical results

- Policy type

- Age

- Risk level

Once approved, your advisor will deliver your policy contract.

Step 8: Pay Your Premium and Keep Your Policy Active

Pay on time to keep coverage intact.

Set auto-reminders or automatic payments so you never miss a due date.

Getting life insurance doesn’t need to be complicated. With the right steps, you can secure protection that fits your life, your goals, and your family.

🙋 Frequently Asked Questions About Life Insurance in the Philippines

• What’s the best type of life insurance for beginners?

For pure, affordable protection, term life insurance is the best starting point. It gives high coverage for low premiums. If you want lifetime protection or savings, whole life works better. VUL is ideal only if you’re comfortable with long-term investing.

• Is life insurance expensive in the Philippines?

Not necessarily. Term life can cost as low as ₱2,000 to ₱10,000 per year depending on age and coverage. Whole life and VUL policies cost more but offer additional benefits. The key is choosing a plan that fits your budget and goals.

• Can I get life insurance without a medical exam?

Yes. Many microinsurance, group life, and small-coverage plans don’t require medical exams. Larger coverage amounts or VUL plans typically require health screening for approval.

• How much life insurance coverage do I need?

A practical rule is at least 10 times your annual income. Add extra if you have children, loans, or large financial responsibilities. If that amount is too expensive, start with what fits your budget and increase coverage later.

• Which is better, term or VUL?

Neither is universally better. Term is affordable and offers pure insurance protection. VUL offers both insurance and investment, but costs more and carries market risk. Your choice depends on your budget and comfort with investing.

• What happens if I miss a premium payment?

Most policies have a 30-day grace period. If you still don’t pay, the policy may lapse or automatically draw from your cash value (for VUL or whole life). Always check your due dates to keep coverage active.

• Can OFWs get life insurance?

Yes. Many insurance companies allow OFWs to apply, sometimes even online. Requirements may include valid IDs, remittance records, and medical evaluation depending on the policy.

• Is it safe to buy life insurance online?

Yes, as long as the provider is reputable and the advisor is licensed. Always verify SEC/IC registrations and avoid agents asking for payments via personal accounts.

• Will my life insurance pay out immediately if something happens to me?

Most claims are processed within 7–30 days after submitting complete documents. Certain exclusions (like suicide within the first 1–2 years or undisclosed illnesses) may affect payout.

• Can I have more than one life insurance policy?

Yes. Many Filipinos combine term insurance for large coverage with VUL or whole life for long-term savings. What matters is you can afford the premiums consistently.

🌅 Protection Today, Peace Tomorrow

Life insurance isn’t just another financial product — it’s a quiet promise you make to the people you love. It’s you saying, “If life gets hard, you won’t face it alone.” And for countless Filipino families, that promise makes all the difference. It turns uncertainty into stability and fear into confidence.

You don’t need to be an expert to make a smart choice. You just need clarity, honesty about your needs, and a plan that fits your life — not someone else’s. When you match the right policy to your goals and budget, life insurance stops feeling intimidating and starts feeling empowering.

Start with what you can. Upgrade when you’re ready. What matters is taking the first step toward protecting your family’s future. Because at the end of the day, insurance isn’t really about money — it’s about love, responsibility, and peace of mind that lasts far beyond today.