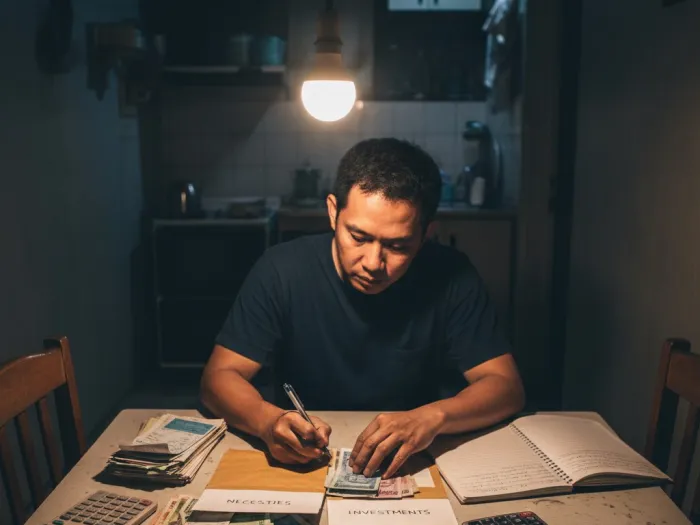

Most Filipinos reach a point where saving isn’t enough anymore. Prices rise, bills pile up, and even with careful budgeting, the money we keep doesn’t grow – it just survives. So when someone searches for the best investment options for Filipinos, it usually comes from a simple, honest goal: “I want my money to work, not just sit there.”

- 💡 Why Filipinos Should Start Investing Early

- 🌿 Best Investments for Beginners: Safe and Low-Risk Options

- 📊 Moderate-Risk Investments: Better Growth With Acceptable Volatility

- ⚡ High-Risk, High-Reward Investments: For Confident and Experienced Investors

- 🧭 What Type of Investment Is Right for You? Choosing Based on Your Risk Profile

- 💰 How Much You Should Invest: Practical Budgeting for Beginners

- 📦 Building Your First Investment Portfolio (Simple Sample Mix for Beginners)

- 🙋 Frequently Asked Questions About Investing for Filipinos

- 🌅 Investing Isn’t Just About Money — It’s About Direction

- 📚 References

If that’s where you are right now, you’re in the right place.

This guide is designed for beginners – people who want clear explanations, real-world examples, and investment options that fit normal Filipino budgets, not corporate salaries. No hype. No financial jargon. Just practical, safe, beginner-friendly choices you can understand even if this is your first time learning about investing.

Whether you’re trying to beat inflation, build a future for your kids, or simply stop feeling stuck sa paycheck cycle, this article will walk you through the smartest places to start.

💡 Why Filipinos Should Start Investing Early

Most Filipinos learn about money the hard way. We save what we can, we stretch every peso, but at some point reality hits: savings alone can’t keep up with life. Prices rise, responsibilities grow, and kahit gaano ka pa kaingat, a bank account earning 0.10% interest per year simply won’t protect you from inflation. That’s the moment investing starts to matter — not as an “extra,” but as a necessity.

Here’s why starting early changes everything.

📈 1. Your Money Grows Faster Than Inflation

Inflation is the quiet enemy. Your money stays the same, but the cost of everything around you keeps climbing.

- Yung ₱500 dati pang-grocery for a week? Now it’s barely enough for a quick meal.

- Yung tuition na ₱20,000 noon? It’s double or triple today.

Investing helps your money grow at a rate that can beat inflation, so your purchasing power doesn’t slowly crumble. Even small investments performed consistently can protect your future self from feeling financially stuck.

⏳ 2. Time Is the Most Powerful Wealth Builder

Many beginners think investing requires big capital. It doesn’t. What you actually need is time.

Time allows:

- Your investment to grow

- Your earnings to earn more earnings

- Small contributions to eventually snowball

This is compounding — and it’s the quiet force that turns ordinary savers into wealthy people over years, not months.

Starting early means you let compounding work in your favor for a much longer period. Starting late means you have to invest more just to catch up.

🧩 3. You Build a Safety Net You Don’t Have to Panic Over

Most Filipinos have only two options during emergencies:

- Borrow money

- Use their savings (if they have any)

Investing creates a third option — a growing financial cushion.

Over time, your investments can act as:

- Emergency backup

- Tuition buffer

- Health fund

- “Just in case” money

This doesn’t mean you withdraw at every small problem, but you gain confidence knowing something is growing quietly in the background.

🚀 4. You Unlock Bigger, Long-Term Life Goals

Savings can handle small goals; investing fuels big ones.

If you want:

- A house

- A business

- A strong retirement fund

- A college fund for your kids

You need growth — not just storage.

Investing allows your money to accelerate these dreams instead of making you rely purely on your income.

🌱 5. You Slowly Break the Sweldo-to-Sweldo Cycle

This is the mission for many Filipinos.

You work hard, you get paid, the money disappears, and you start again.

Investing is how you slowly step out of that loop.

- Your income grows

- Your investments grow

- Your future becomes less dependent on a single paycheck

Bit by bit, you shift from working for your money to letting money work for you.

And that small shift changes your entire life trajectory.

🌿 Best Investments for Beginners: Safe and Low-Risk Options

When you’re just starting out, the goal isn’t to chase the highest returns. It’s to protect your money, understand how investing works, and build confidence. Many Filipinos avoid investing because they fear losing money — and that’s valid. So this section focuses on the safest, most beginner-friendly options that let you grow without overwhelming risk.

Treasury Bills (T-Bills)

These are short-term government securities where you lend money to the Philippine government. They’re one of the safest investments available because the government guarantees repayment.

- Minimum investment: around ₱5,000

- Terms: 91, 182, or 364 days

- Ideal for: new investors and those who prefer predictable returns

- Risk level: very low

You earn by buying the T-Bill at a discount then getting its full value upon maturity. Simple, safe, and great for beginners.

Treasury Bonds (RTBs, Premyo Bonds)

These are longer-term versions of T-Bills. They pay interest every quarter, and because they’re government-backed, they’re extremely secure.

- Minimum investment: ₱5,000

- Tenure: 3 to 10 years

- Ideal for: Filipinos building medium to long-term savings

- Risk level: very low

They’re perfect for people who want a “set it and forget it” investment that beats bank interest.

Time Deposits

If you want something familiar, time deposits offer slightly higher interest than savings accounts.

- Minimum investment: ₱1,000 to ₱10,000 depending on the bank

- Terms: 30 days to 5 years

- Risk level: low

It’s stable, predictable, and a stepping stone for people transitioning from pure savings to actual investing.

Mutual Funds

These pool money from different investors and are managed by professionals. They’re a great first step into the world of financial markets because you don’t pick stocks yourself.

- Minimum investment: usually ₱1,000 to ₱5,000

- Types: equity, bond, balanced funds

- Risk level: low to medium

Mutual funds let you own a diversified portfolio instantly, even with small capital.

UITFs (Unit Investment Trust Funds)

Similar to mutual funds but offered by banks. You place money, and the bank manages the fund for you.

- Minimum investment: ₱1,000 to ₱10,000

- Types: balanced, bond, equity

- Risk level: low to medium

UITFs are convenient because everything is done through your banking app or branch.

Pag-IBIG MP2

Pag-IBIG MP2 is a favorite among Filipinos because it’s safe, easy to start, and pays higher dividends than most savings products.

- Minimum investment: ₱500

- Lock-in: 5 years

- Average returns: higher than banks and even some funds

- Risk level: very low

It’s especially good for beginners who want guaranteed growth from a reliable government-backed program.

Short-Term Corporate Bonds

If you’re ready to explore beyond government securities, corporate bonds offer slightly higher returns from trusted companies.

- Minimum investment: ₱10,000 to ₱20,000

- Risk level: low to medium

- Best for: conservative investors looking for higher yields

Just choose stable, well-established companies with good credit ratings.

This is the foundation — the safe, practical options that help beginners build confidence without taking on unnecessary risk.

📊 Moderate-Risk Investments: Better Growth With Acceptable Volatility

Once you’re comfortable with the basics and ready for slightly higher returns, moderate-risk investments give you more growth potential without diving into the deep end. These options move with the market, so they rise and fall, but over the long run they often outperform safer instruments. The key is patience, consistency, and understanding that temporary dips are normal.

Index Funds

Index funds track a broad market index like the PSEi. Instead of buying individual stocks, you invest in the entire market basket.

- Minimum investment: ₱1,000 to ₱5,000

- Best for: long-term investors who want steady market growth

- Risk level: medium

They’re popular because they reduce the stress of picking “which stock is the best.” You simply follow the overall market performance.

Blue-Chip Stocks

These are shares of the largest, most stable companies in the Philippines – the kinds that survive recessions and dominate their industries.

- Examples: SM, Ayala, Jollibee, BDO

- Best for: long-term investors building a strong portfolio

- Risk level: medium

They’re not immune to price drops, but their long-term growth tends to remain strong.

REITs (Real Estate Investment Trusts)

REITs let you invest in income-generating properties like malls, offices, and hotels without buying actual real estate.

- Minimum investment: ₱1,000

- Returns: regular dividends + potential price appreciation

- Risk level: medium

They’re ideal for Filipinos who want real estate-like income without the huge capital.

Balanced Funds

These combine bonds and stocks into one fund. The bond portion adds stability; the stock portion adds growth.

- Minimum investment: ₱1,000 to ₱5,000

- Best for: beginners who want growth but still want some cushion

- Risk level: medium

They’re a good middle ground if you’re transitioning from conservative investments.

Equity Mutual Funds or Equity UITFs

These focus mainly on stocks and are managed by professionals.

- Minimum investment: ₱1,000 to ₱10,000

- Best for: investors aiming for higher long-term returns

- Risk level: medium to moderately high

They’re suitable for Filipinos with a long time horizon who won’t panic when the market dips.

These moderate-risk investments reward patience. They move in cycles, and that’s normal. Over time, they tend to grow stronger than safer investments — but only if you stay consistent and avoid emotional decisions when the market fluctuates.

⚡ High-Risk, High-Reward Investments: For Confident and Experienced Investors

These investments offer the biggest potential gains, but they also come with noticeable volatility. Prices can swing up or down quickly, and it takes emotional discipline, research, and a long-term mindset to navigate them. They’re not ideal for beginners, but they’re worth understanding so you know what’s out there and whether you’ll want to explore them in the future.

Individual Stocks (Non–Blue Chip)

These are smaller, less stable companies with higher growth potential but bigger downside risk.

- Best for: experienced investors who study charts, company reports, and market trends

- Risk level: high

It’s possible to earn big returns here, but you can also lose money if the company underperforms. Only invest amounts you can afford to hold long-term.

Cryptocurrency

Crypto has produced both millionaires and cautionary tales. Prices can skyrocket – or crash overnight.

- Best for: investors who understand crypto markets and accept extreme volatility

- Risk level: very high

If you ever choose to invest in crypto, treat it like a small satellite portion of your portfolio, not your main strategy.

Forex Trading

Foreign exchange trading is fast-paced and unpredictable. It requires technical analysis, emotional control, and a deep understanding of global markets.

- Best for: seasoned traders

- Risk level: very high

Most Filipinos who try forex without proper training lose money. Only enter if you’re well-prepared and have a clear risk management plan.

Leveraged Trading (Stocks, Crypto, Forex)

Leveraged platforms allow you to borrow money to trade larger positions.

- Best for: investors with strong experience

- Risk level: extremely high

While gains can multiply, losses can also escalate quickly. It’s not recommended for people with low risk tolerance.

Startup or Small Business Investing

Investing in early-stage businesses or startups can bring big returns, but most new businesses fail in their first few years.

- Best for: investors who can evaluate business models and market potential

- Risk level: high

This can work well if you know the industry or have hands-on involvement, but never invest more than you’re willing to lose.

NFT Projects & Digital Assets

Some Filipinos entered NFTs during the hype cycle. While there are legitimate projects, many are speculative or short-lived.

- Risk level: very high

- Best for: those who deeply understand blockchain ecosystems

Approach cautiously. Hype can fade quickly, leaving investors with losses.

High-risk investments can deliver impressive gains, but only if you know the risks and can handle the volatility without panicking. They should never make up your whole portfolio, especially if you’re still building financial stability.

🧭 What Type of Investment Is Right for You? Choosing Based on Your Risk Profile

Not all investments fit everyone. Some people sleep better with safe, predictable returns. Others enjoy the excitement of market movements. What matters is choosing based on your risk tolerance, life situation, and financial goals. When you know your profile, you avoid stress, panic-selling, and regret.

Conservative Investors

You prefer safety over high returns. You don’t like seeing your money drop, even temporarily. Stability helps you feel in control.

Ideal options:

- Treasury Bills

- Treasury Bonds (RTBs, Premyo Bonds)

- Time Deposits

- Pag-IBIG MP2

- Bond Funds / Bond UITFs

These prioritize capital preservation while still giving you better growth than a savings account.

Moderate Investors

You’re open to some risk if it means better long-term returns. Short-term dips don’t scare you too much as long as the trend points upward.

Ideal options:

- Index Funds

- Balanced Funds

- Blue-Chip Stocks

- Equity Mutual Funds or UITFs

- REITs

You balance growth and safety by diversifying your portfolio.

Aggressive Investors

You have a higher tolerance for volatility. You’re comfortable with short-term losses if they lead to bigger gains in the future.

Ideal options:

- Individual non–blue-chip stocks

- Crypto

- Forex

- Startup investing

- Leveraged trading (if highly experienced)

This profile suits people with longer time horizons and surplus funds they can afford to take risks with.

How to Know Your Risk Profile

Ask yourself:

- How do I feel when my investment drops temporarily?

- Am I investing for short-term needs or long-term goals?

- Do I panic easily when markets go down?

- How stable is my income?

- Do I have an emergency fund already?

Your honest answers will guide you toward the right mix of investments.

Why Matching Your Profile Matters

Choosing the wrong type of investment leads to stress.

A conservative person forced into high-risk assets will panic during dips.

An aggressive person forced into time deposits will feel frustrated by slow growth.

The goal is peace of mind — growing your money and sleeping well at night.

💰 How Much You Should Invest: Practical Budgeting for Beginners

One of the biggest fears beginners have is not knowing how much they’re “supposed” to invest. Many imagine they need huge amounts to start, but the truth is simpler and far more realistic. Investing isn’t about the size of your first deposit — it’s about consistency and choosing an amount that doesn’t break your monthly budget.

Start Small and Grow Slowly

You don’t need tens of thousands to begin. Even ₱500 to ₱1,000 a month is already a solid starting point. What matters is building the habit, not impressing anyone with big contributions. Over time, small consistent amounts can grow surprisingly well.

Follow the 20% Savings Rule (If Possible)

A good baseline is to save or invest 20% of your monthly income, but this isn’t mandatory. If 20% feels too heavy because of bills or family responsibilities, start with 5% or 10%. The goal is not perfection, but progress.

Make Sure You Have an Emergency Fund

Before committing too much to investments, make sure you have at least 1 to 3 months worth of expenses saved. This fund protects you from emergencies so you don’t need to suddenly withdraw your investments or borrow money when things get tough.

Match Your Budget to Your Goals

How much you invest also depends on what you’re working toward:

- Short-term goals (1–3 years): choose safer investments and invest smaller amounts

- Medium-term goals (3–7 years): balanced or moderate-risk options work well

- Long-term goals (7+ years): you can invest more into higher-growth assets like index funds and stocks

Align your monthly amount with how soon you need the money.

Automate Your Contributions

If possible, set up automatic transfers or reminders. This removes the emotional hesitation and makes investing feel like a normal part of your monthly routine, just like paying bills.

Adjust When Your Income Changes

If you get a salary increase, bonus, or side-hustle income, slowly raise your monthly investment amount. Even an extra ₱200 to ₱500 makes a difference over time.

Consistent investing — even in small amounts — builds confidence and momentum. You’re not racing anyone; you’re building your future at your own pace.

📦 Building Your First Investment Portfolio (Simple Sample Mix for Beginners)

Starting your first portfolio doesn’t need to feel overwhelming. You’re not expected to know every investment type right away. The goal is simply to create a balanced mix that fits your comfort level, budget, and long-term plans. A good beginner portfolio is one that’s easy to understand, low-maintenance, and steady enough to keep you investing consistently.

Why You Need a Portfolio Mix

Putting all your money into just one investment increases your risk. A portfolio spreads your money across different assets so that if one performs poorly, the others help balance things out. It’s a simple way to make your financial life more stable.

Beginner-Friendly Portfolio Examples

Here are easy sample mixes you can follow depending on your risk tolerance:

Conservative Portfolio

For those who want very low risk and prefer stable returns:

- 50% Pag-IBIG MP2

- 30% Treasury Bonds (RTBs)

- 20% Time Deposit or Money Market Fund

This mix grows slowly but steadily, perfect for cautious beginners.

Moderate Portfolio

For those comfortable with some market movement:

- 40% Index Fund

- 30% Pag-IBIG MP2

- 30% Bond Fund or RTBs

This offers balanced growth with moderate volatility.

Aggressive Portfolio

For those investing long-term and okay with temporary dips:

- 60% Stock/Equity Index Fund

- 20% REITs

- 20% Bond Fund

This mix focuses on long-term gains. It won’t always be smooth, but it can grow faster over the years.

How Often Should You Add Money?

Most beginners invest monthly because it matches the sweldo cycle. Monthly investing helps you build discipline and reduces the impact of market ups and downs — a strategy known as peso-cost averaging.

How Often Should You Review Your Portfolio?

Every 6 to 12 months is enough. You don’t need to check daily; that only creates panic. Instead, review:

- Is your mix still aligned with your goals?

- Has your income changed?

- Are you now more comfortable with risk?

Small adjustments over time keep your portfolio healthy without stress.

Keep It Simple

Your first portfolio doesn’t have to be perfect. It just needs to be consistent. Once you’re comfortable, you can explore more options, adjust your mix, or add new assets — step by step, not all at once.

🙋 Frequently Asked Questions About Investing for Filipinos

• How much money do I need to start investing in the Philippines?

You can start with as little as ₱500 to ₱1,000 depending on the investment platform. Pag-IBIG MP2, mutual funds, UITFs, and even some stock apps allow very low minimums. The real key is consistency, not a large starting amount.

• What is the safest investment for beginners in the Philippines?

Government-backed instruments like Treasury Bills, Retail Treasury Bonds, and Pag-IBIG MP2 are among the safest. They offer predictable returns, low risk, and are ideal for first-time investors who want security over high growth.

• Can I invest even if I’m sweldo-to-sweldo?

Yes. You can start small – even ₱300 to ₱500 a month makes a difference when done consistently. Begin with low-risk options, then increase your investment amount as your income stabilizes or grows.

• What investment gives the highest returns?

High-risk assets like stocks, crypto, and individual growth companies can give high returns, but they also come with bigger losses. Beginners should first build a foundation with low to moderate-risk investments before exploring these options.

• How do I choose what investment fits me best?

Consider your risk tolerance, goals, and timeframe. If you panic when prices drop, choose safe options. If you’re investing for long-term goals like retirement, moderate portfolios like index funds may fit you better. Match your investment to your personality and lifestyle.

• Is it better to invest monthly or one-time big amount?

Monthly investing (peso-cost averaging) is easier for Filipinos because it matches the salary cycle and reduces timing risk. If you receive bonuses or extra income, you can add one-time amounts on top of your monthly contributions.

• Do I need a financial advisor to start investing?

No. Many platforms are beginner-friendly and offer guides inside their apps. Advisors can help, but they’re optional. What matters is choosing trusted platforms and understanding the basics before putting in your money.

• Should I invest if I don’t have an emergency fund yet?

Build your emergency fund first if possible. A buffer of 1 to 3 months’ worth of expenses protects you from sudden setbacks so you don’t need to withdraw your investments early or borrow money during emergencies.

• Is investing risky?

Yes, but not all investments carry the same level of risk. Low-risk options like T-Bills and MP2 are very stable, while stocks and crypto can fluctuate. Understanding your risk tolerance keeps you from making emotional decisions.

• How do beginners avoid scams when investing?

Stick to government-backed programs, licensed banks, SEC-registered funds, and reputable platforms. Avoid investments promising “guaranteed high returns in a short time” — these are classic red flags in the Philippines.

🌅 Investing Isn’t Just About Money — It’s About Direction

Most Filipinos grow up thinking investing is only for the rich, the educated, or the people who already “made it.” But the truth is the opposite. Investing is how ordinary people slowly build their future — quietly, steadily, month after month. You don’t need a big salary. You don’t need perfect timing. You just need the willingness to start and the patience to keep going.

Because every peso you invest is a small promise to your future self. It’s you saying: “Hindi ako susuko sa buhay na puro habol sa gastos. I’m building something for myself, my kids, my family.” And that mindset alone already sets you apart.

So take your time. Learn one step at a time. Start small if needed. What matters is the direction — not the speed, not the amount, not what anyone else is doing. Your journey is yours alone, and every little move forward counts.

If you’re reading this now, it means you care about your future. And that’s the strongest start anyone can ask for.